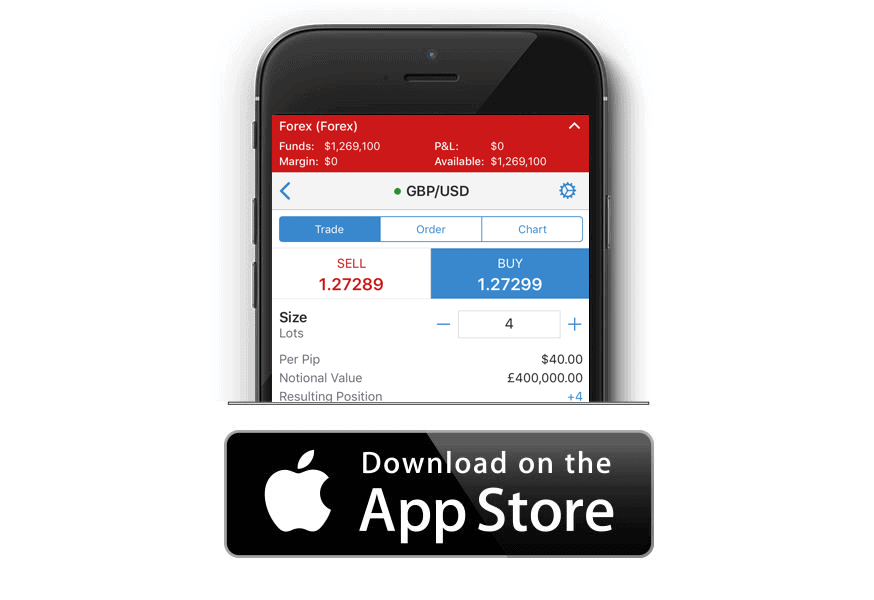

Here's a rare offer: Open a trading account with $0 commission. iFOREX gives you a rare market advantage, offering you the ability to trade stocks with $0 commission. Access the market immediately, invest in stock derivatives and enjoy the support of an online broker with over 25 years of experience. Online stock trading. Direct access to global markets and the ability to invest in the price of top stocks 18/10/ · NEW YORK, NY / ACCESSWIRE / October 17, / BEX, a crypto leverage trading platform, officially announces that on Oct 1st it has launched Forex and Commodity leverage trading up to x Thus, the spreads will start from 0 pips through the received interbank quotes, while trading costs are most commonly charged by the fixed commission per trade. The Zero spread forex Brokers are typically NDD, STP or ECN companies that provides direct access to the market and deep liquidity

Trade Stocks and Enjoy $0 Commission

BEX, has seen rapid growth since with traditional BTC perpetual contract up to x leverage, why bother to revolutionize its product? That is why we introduced Forex and Commodity". Although lucrative, crypto market succumbs to external influences ranging from "expert analysis" to "a Facebook Libra plan". The importance of asset diversification can not be overstated, 0 commission forex trading.

Gary P. Brinson, 0 commission forex trading, CFA, Randolph Hood, and Gilbert L. Beebower known collectively as BHB asserted that asset allocation is the primary determinant of a portfolio's return variability, and came to conclude that asset allocation explained 0 commission forex trading BEXa trader can switch to another market such as Commodity including gold and crude oil, or Forex trading in a stagnant crypto market.

We offer fixed and tight spreads for traders to better control their costs, especially infrequent trading, Isabella explained. Launched inBEX has clients from over countries and regions. Co-founders, experienced in traditional equity, forex industry and hedge funds, apply their financial methodology to the crypto industry.

The company was devoted to revolutionize the industry with its tight spread, competitive commissions and adaptable trading platform. Unlike normal bonus programs in the market which provide the digital bonus only exist in users account only and unable to withdraw, 0 commission forex trading, Bex bonus program provides withdrawable bonus to all users.

The Bonus in Bex can also cover the loss of your position. Come and get your first Bex Bonus. View source version on accesswire. And yet now, in the oil world, it looks like this time really will be. Even in the Permian, the prolific shale basin at the center of the U. energy boom, drillers are resisting their traditional boom-and-bust cycle of spending. The oil industry is on the ropes, constrained by Wall Street investors demanding that companies spend less on drilling and instead return more money to shareholders, and climate change activists pushing against fossil fuels.

Exxon Mobil Corp. is paradigmatic of the trend, after its humiliating defeat at the 0 commission forex trading of a tiny activist elbowing itself onto the board. As non-OPEC output fails to rebound as fast as many expected -- or feared based on past experience -- the cartel is likely to continue adding more supply when it meets on June 1. And now they have to. Royal Dutch Shell Plc lost a landmark legal battle last week when a Dutch court told it to cut emissions significantly by -- something that would require less oil production, 0 commission forex trading.

Many in the industry fear a wave of lawsuits elsewhere, with western oil majors more immediate targets than the state-owned oil companies that 0 commission forex trading up much of OPEC production.

Beyondoil output is likely to rise in a handful of nations, including the U. But production will decline elsewhere, from the U.

to Colombia, Malaysia and Argentina. After all, the coronavirus pandemic continues to constrain global oil demand. It may be more noticeable later this year and into By then, 0 commission forex trading, vaccination campaigns against Covid are likely to be bearing fruit, and the world will need more oil, 0 commission forex trading. The expected return of Iran into the market will provide some of that, but there will likely be a need for more.

When that happens, it will be largely up to OPEC to plug the gap. One signal of how the recovery will be different 0 commission forex trading time is 0 commission forex trading U. drilling count: It is gradually increasing, but the recovery is slower than it was after the last big oil price crash in Shale companies are sticking to their commitment to return more money to shareholders via dividends. The result is that U. crude production has flat-lined at around 11 million barrels a day since 0 commission forex trading Outside the U.

More stories like this are available on bloomberg, 0 commission forex trading. comSubscribe now to stay ahead with the most trusted business news source. Banks are testing out looser restrictions, opening up access to credit to millions. The British pound continues to be very noisy, as we try to press the 1.

We have failed, so now it looks like a pullback could be coming. PCE is the Federal Reserve's preferred measure of inflation. In the 12 months through April, the core PCE price index surged 3. Welcome back, Costco food courts. Over 3, people have contracted the virus in 30 of its 63 cities and provinces since late April.

Four business sources acknowledged operational hit following lockdown, which triggered supply chain disruption concerns. One Apple supplier had temporarily divided its workforce over two shifts, 0 commission forex trading.

Vietnam had begun vaccinating workers in the two most affected provinces Bac Ninh and Bac Giang, based on the health ministry statement. Bac Ninh is responsible for significant Samsung operations and imposed a curfew and other travel restrictions. LG Electronics Inc OTC: 0 commission forex tradingFoxconn Technology Co Ltd OTC: FXCOFand 0 commission forex trading have operations or supply chain companies in the area.

A Xiaomi Corp OTC: XIACFHuawei Technologies Co. The government planned to gradually reopen four industrial parks closed a week earlier due to the pandemic. Some of the lower-tier South Korean suppliers were also struggling. Price action: AAPL shares traded lower by 0. See more from BenzingaClick here for options trades from BenzingaNew Bill To Impose Counterfeit Goods Sale Liability On Amazon, eBay: BloombergElastic's Osquery Host Management Integration Now Addresses Cyber Threats© Benzinga.

Benzinga does not provide investment advice. All rights reserved. Bloomberg -- Stock splits are back in vogue among big U. companies, reviving a debate about whether the practice that had fallen out of favor for years is worth the fuss. Last week, Nvidia Corp. and Tesla Inc. Yet that has done little to settle the age-old-argument among investors about whether such stock-price engineering has any bearing on performance.

In fact, recent developments such as soaring retail trading and fractional share ownership have only heated things up. Once a reliable hallmark of bull-market exuberance, the practice had until recently fallen out of favor.

Three companies -- Nvidia, Paccar Inc. and Cummins Inc. Inthere were only two. Limited Benefits A look at the data backs up the case against splits providing long-term benefits to stock performance. The calendar year following the move, however, those same shares underperformed four of the five years.

The recent rash of stock splits has sparked speculation that other large technology companies like Amazon. com Inc, 0 commission forex trading. that boast four-digit share prices may be next. Regardless of what the historical-performance record shows, the surge in retail trading over the past year may be altering the calculus for companies when it comes to evaluating splits.

retail investors are now second in share trading only to market makers and independent high-frequency traders, according to Larry Tabb, 0 commission forex trading of market structure research at Bloomberg Intelligence. The retail segment is now larger than quantitative investors, hedge funds and traditional long-only participants, said Tabb. It just opens up the market that much more for retail investors. Here's why more than 50, homeowners are losing their policies. Bloomberg -- National Bank of Canada shares fell the most in four months after its fiscal second-quarter results underwhelmed investors following a week of blowout earnings from its peers.

Revenue in the unit slipped 5. Helping net income 0 commission forex trading a big decrease in provisions for credit losses. Revenue in the unit rose 6.

Bloomberg -- The glut of spare cash in dollar funding markets is combining with inflation concerns to 0 commission forex trading debate among investors about just how soon the Federal Reserve might have to take its foot off the accelerator. jobs data, which may give clues about just how strong growth and inflation really are. The drumbeat of policy makers making noises about when the Fed should debate tempering its asset purchases has been quickening, although officials have been careful to say that their views are premised on the economy continuing to power forward and the prospects for sustained inflation.

The strength of the upcoming labor market report is therefore set to be a major catalyst for bets about when both tapering and rate hikes might begin to take place, as will the evolution of funding markets. Money-market traders are currently pricing in about 18 basis points worth of Fed rate hikes by the end of next year -- down around 3 basis points from levels late last month.

Before they even get to that point though, officials need to get through tapering, and most analysts expect there to be a lag before they embark on pushing interest rates higherAsymmetric RiskThe yield on year notes has drifted slightly lower over the past couple of weeks, although it received some support in recent days from reports about government budget proposals and at around 1.

Bond-market inflation expectations, as measured by so-called breakeven rates, have also eased back slightly, although they remain within sight of the decade highs they reached earlier in May. Some traders are wary that the upcoming report on May job creation could reignite the move higher in long-term yields.

There is also the prospect of a revision to figures for April, which came in at arounddespite earlier predictions for a gain of 1, What to WatchThe Treasuries market will be closed Monday for a U. Below are the calendar highlights. The economic calendarJune 1: Markit U. manufacturing purchasing managers index; construction spending; Institute for Supply Management manufacturing gauge; Dallas Fed manufacturing indexJune 2: MBA mortgage applications; Fed Beige Book; vehicle salesJune 3: Challenger 0 commission forex trading cuts; ADP employment change; nonfarm productivity; weekly jobless claims; Langer consumer comfort; Markit U.

services PMI; ISM services indicatorJune 4: Monthly jobs report; factory, durable goods and capital goods ordersThe Fed calendar:June 1: Fed Vice Chairman for supervision Randal Quarles; Fed Governor Lael BrainardJune 2: Philadelphia Fed President Patrick Harker; Chicago Fed President Charles Evans; Atlanta Fed President Raphael Bostic; Dallas Fed President Robert KaplanJune 3: Bostic; Kaplan; Harker; QuarlesJune 4: Fed Chair Jerome Powell takes part in a Bank for International Settlements panel on climate change with European Central Bank President Christine Lagarde and other officialsThe auction calendar:June 1: week bills, week bills, day cash management billJune 0 commission forex trading 4-week bills, 8-week billsMore stories like this are available on bloomberg.

Best Forex Broker for Indian Forex Traders - Ajaymoney

, time: 11:35# 10 Forex Brokers with ZERO (no) Spreads | Comparison

Thus, the spreads will start from 0 pips through the received interbank quotes, while trading costs are most commonly charged by the fixed commission per trade. The Zero spread forex Brokers are typically NDD, STP or ECN companies that provides direct access to the market and deep liquidity 18/10/ · NEW YORK, NY / ACCESSWIRE / October 17, / BEX, a crypto leverage trading platform, officially announces that on Oct 1st it has launched Forex and Commodity leverage trading up to x Here's a rare offer: Open a trading account with $0 commission. iFOREX gives you a rare market advantage, offering you the ability to trade stocks with $0 commission. Access the market immediately, invest in stock derivatives and enjoy the support of an online broker with over 25 years of experience. Online stock trading. Direct access to global markets and the ability to invest in the price of top stocks

No comments:

Post a Comment