2. · cases, basis for) transactions to you and the IRS on Form B. Reporting is also required when your broker knows or has reason to know that a corporation in which you own stock has had a reportable change in control or capital structure. You may be required to recognize gain from the receipt of cash, stock, or other property that 6. 6. · Forex tax calculation, if you are with a broker that doesnt provide B? then how do we report forex tax? By default, retail FOREX traders fall under Section , which covers short-term foreign exchange contracts like spot FOREX trades. Section taxes FOREX gains and losses like ordinary income, which is at a higher rate than the capital Estimated Reading Time: 50 secs 8. · Taxpayer received a Form treating his forex contracts like forwards (or forward-like). issuance rules state that a should be issued for forex forwards, treating them like Section (g) foreign currency contracts. Those same rules say no should be issued for spot forex

Why do forex forward dealers issue s, yet spot forex brokers do not? | Green Trader Tax

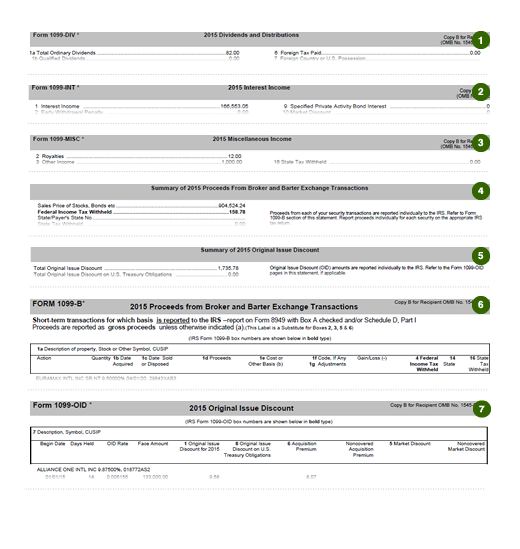

Form B PDF. Instructions for Form B Print Version PDF. Correction to the and Instructions for Form B, Forex 1099b 9 "Unrealized Profit or Loss on Open Contracts" -- JUN All Form B Revisions.

Online Ordering for Information Returns and Employer Returns. About PublicationCorporations. About PublicationGeneral Rules and Specifications for Substitute Forms, and Certain Other Information Returns. PublicationSpecifications for Electronic Filing of Forms, forex 1099b, and W-2G Forex 1099b. Other Current Products.

Home Forex 1099b and Instructions About Form B, Proceeds from Broker and Barter Exchange Transactions. More In Forms and Instructions. A broker or barter exchange must file this form for each person: For whom, they sold stocks, commodities, regulated futures contracts, foreign currency contracts, forward contracts, debt instruments, options, securities futures contracts, etc.

Current Revision Form B PDF Instructions for Form B Print Version Forex 1099b. All Form B Revisions Online Ordering for Information Returns and Employer Returns About PublicationCorporations About PublicationGeneral Rules and Specifications for Substitute Forms, and Certain Other Information Returns PublicationSpecifications for Electronic Filing of Forms,, and W-2G PDF Other Current Products.

Related Items About General Instructions for Certain Information Returns. About Form CAP, forex 1099b, Changes in Corporate Control and Capital Structure, forex 1099b. About Form MISC, Miscellaneous Income. About FormInformation Return for Acquisition of Control or Substantial Change in Capital Structure. About FormSales and other Dispositions of Capital Assets. About FormReport of Organizational Actions Affecting Basis of Securities. About Instructions for the Requester of Forms W—8 BEN, W—8 BEN—E, W—8 ECI, W—8 EXP, and W—8 IMY.

About Form W-9, Request for Taxpayer Identification Number and Certification. About Schedule D Form or SRCapital Gains and Losses. Page Last Reviewed or Updated: Mar Share Facebook Twitter Linkedin Print.

FOREX BASICS TO ADVANCED LEVEL COURSE VIDEO - Forex Trading Is illegal In India ? Income Tax ? TAMIL

, time: 14:02About Form B, Proceeds from Broker and Barter Exchange Transactions | Internal Revenue Service

6. 6. · Forex tax calculation, if you are with a broker that doesnt provide B? then how do we report forex tax? By default, retail FOREX traders fall under Section , which covers short-term foreign exchange contracts like spot FOREX trades. Section taxes FOREX gains and losses like ordinary income, which is at a higher rate than the capital Estimated Reading Time: 50 secs What is a Foreign Exchange Gain/Loss? A foreign exchange gain/loss occurs when a company buys and/or sells goods and services in a foreign currency, and that currency fluctuates relative to their home currency. It can create differences in value in the monetary assets and liabilities, which must be recognized periodically until they are ultimately settled 2. · cases, basis for) transactions to you and the IRS on Form B. Reporting is also required when your broker knows or has reason to know that a corporation in which you own stock has had a reportable change in control or capital structure. You may be required to recognize gain from the receipt of cash, stock, or other property that

No comments:

Post a Comment