“Buy stop” to open a long position at the price higher than the current price “Sell stop” to open a short position at the price lower than the current price “Buy Limit” to open a long position at the price lower than the current price “Sell Limit” to open a short position at the price higher than the current price 22/03/ · Stop limit orders ensure there’s no slippage from your set price, but your trade won't be executed if the price is unavailable due to low liquidity. Use stop limit orders to execute your trade at the set price, or not at all. If you’re looking for the difference between limit and stop orders, we've also got you covered. Now, let’s go over Estimated Reading Time: 4 mins 03/11/ · Sell limit order means that you are able to sell the instrument for your price or at a higher price. It is used for exiting from a Long position and entering a Short position. Stop order will be opened when the price reaches the level (the level of price) which was indicated by the trader

Binary options Saudi Arabia: Forex difference between stop and limit

Here we discuss the different types of orders that can be placed in the forex market. You would click buy and your trading platform would instantly execute a buy order at that hopefully exact price.

If you ever shop on Amazon. The only difference is you are buying or selling one currency against another currency instead of buying a Justin Bieber CD. When you place a market order, you do not have any control over what price your market order will actually be filled at. A limit order is an order placed to either buy below the market or sell above the market at a certain price. Notice how the green line is below the current price.

If you place a BUY limit order here, in order for it to be triggered, the price would have to fall down here first, forex difference between stop and limit. As you can see, a limit order can only be executed when the price becomes more favorable to you.

Notice how the red line is above the current price, forex difference between stop and limit. If you place a SELL limit order here, in order for it to be triggered, the price would have to rise up here first. You want to go short if the price reaches 1.

You can either sit in front of your monitor and wait for it to hit 1. Or you can set a sell limit order at 1. If the price goes up to 1. You use this type of entry order when you believe the price will reverse upon hitting the price you specified! A limit order to BUY at a price below the current market price will be executed at a price equal to or less than the specified price. A limit order to SELL at a price above the current market price will be executed at a price equal to or more than the specific price.

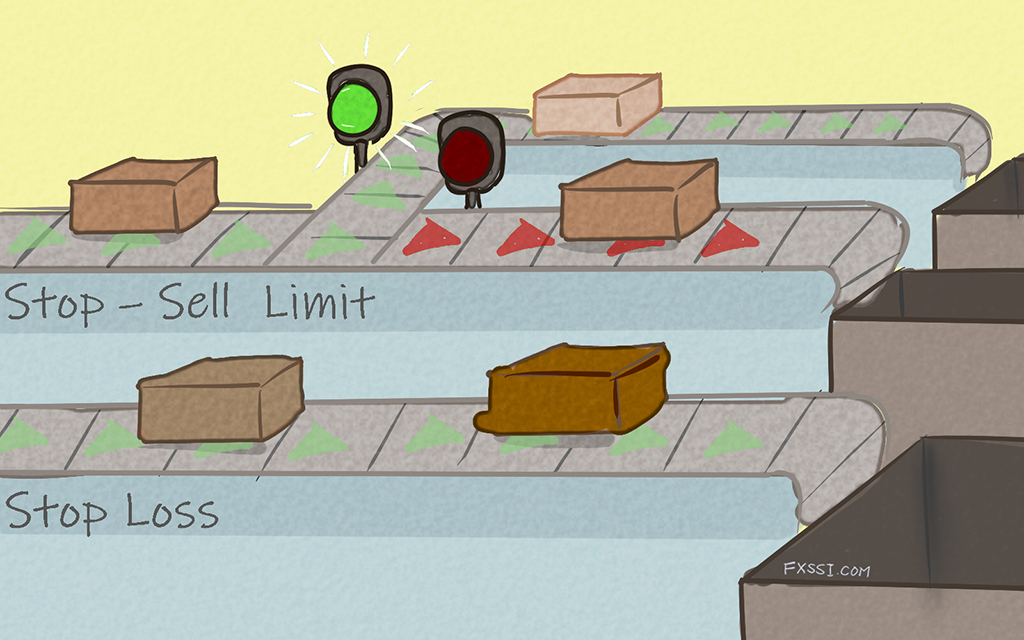

You would use a stop order when you want to buy only after price rises to the stop price or sell only after the price falls to the stop price. A stop entry order is an order placed to buy above the market or sell below the market at a certain price. Notice how the green line is above the current price. If you place a BUY stop order here, in order for it to be triggered, the current price would have to continue to rise. Notice how the red line is below the current price. If you place a SELL stop order here, in order for it to be triggered, the current price would have to continue to fall.

As you can see, a stop order can only be executed when the price becomes less favorable to you. You believe that price will continue in this direction if it hits 1. Forex difference between stop and limit order to close out if the market price reaches a specified price, which forex difference between stop and limit represent a loss or profit. A stop loss order is a type of order linked to a trade for the purpose of preventing additional losses if the price goes against you.

A stop loss order remains in effect until the position is liquidated or you cancel the stop loss order. To limit your maximum loss, you set a stop loss order at 1. Stop orders may be triggered by a sharp move in price that might be temporary. If your stop order is triggered under these circumstances, your trade may exit at an undesirable price. If triggered during a sharp price decline, a SELL stop loss order is more likely to result in an execution well below the stop price.

If triggered during a sharp price increase, a BUY stop loss order is more likely to result in an execution well above the stop price. A stop loss order which is always attached to an open position and which automatically moves once profit becomes equal to or higher than a level you specify. A trailing stop is a type of stop loss order attached to a trade that moves as the price fluctuates.

This means that originally, your stop loss is at If the price goes down and hits Just remember though, that your stop will STAY at this new price level. It will not widen if the market goes higher against you. Once the market price hits your trailing stop price, a market order to close your forex difference between stop and limit at the best available price will be sent and your position will be closed.

A stop order activates an order when the market price reaches or passes a specified stop price. Once the price reaches 1. Basically, your order can get filled at the stop price, worse than the stop price, or even better than the stop price. It all depends on how much price is fluctuating when the market price reaches the stop price. Think of a stop price simply as a threshold for your order to execute.

At what exact price that your order will be filled at depends on market conditions. A limit order can only be executed at a price equal to or better than a specified limit price.

Your order will not be filled unless you can get filled at 1. Think of a limit price as a price guarantee. By setting a limit order, you are guaranteed that your order only gets executed at your limit price or better.

The catch is that the market price may never reach your limit price so your order never executes. A GTC order remains active in the market until you decide to cancel it. Your broker will not cancel the order at any time. Therefore, it is your responsibility to remember that you have the order scheduled.

Think of it as a special instruction used when placing a trade to indicate how long an order will remain active before it is executed or expires. Two orders are placed above and below the current price. When one of the orders is executed the other order is canceled, forex difference between stop and limit.

An OCO order allows you to place two orders at the same time. But only one of the two will be executed. You want to either buy at 1. The understanding is that if 1. An OTO is the opposite of the OCO, as it only puts on orders when the parent order is triggered. You set an OTO order when you want to set profit taking and stop loss levels ahead of time, even before you get in a trade.

You believe that once it hits 1. The problem is that you will be gone for an entire week because you have to join a basket weaving competition at the top of Mt, forex difference between stop and limit. Fuji where there is no internet. In order to catch the move while you are away, you set a sell limit at 1.

As an OTO, both the buy limit and the stop-loss orders will only be forex difference between stop and limit if your initial sell order at 1.

An OTO and OTC order are known as conditional orders. A conditional order is an order that includes one or more specified criteria. The basic forex order types market, limit entry, stop entry, stop loss, and trailing stop are usually all that most traders ever need. Stick with the basic stuff first. Also, always check with your broker for specific order information and to see if any rollover fees forex difference between stop and limit be applied if a position is held longer than one day.

Please note that a market order is an instruction to execute your order at ANY price available in the market. A market order is NOT guaranteed a specific execution price and may execute at an undesirable price. If you would like greater control over the execution prices you receive, submit your order using a limit orderwhich is an instruction to execute your order at or better than the specified limit price. DO NOT trade with real money until you forex difference between stop and limit an extremely high comfort level with the trading platform you are using and its order entry system.

Erroneous trades are more common than you think! People rarely succeed unless they have fun in what they are doing. Dale Carnegie. Partner Center Find a Broker. Next Lesson Demo Trade Your Way to Success.

LIMIT Order or STOP Order - WHICH One Should You Use?

, time: 14:01Buy limit and Buy stop difference in Forex

“Buy stop” to open a long position at the price higher than the current price “Sell stop” to open a short position at the price lower than the current price “Buy Limit” to open a long position at the price lower than the current price “Sell Limit” to open a short position at the price higher than the current price The current market position is below the key level; We expect an upward movement with a breakout of this level. A Buy limit order is used when we expect a bullish rebound or a reversal of a bearish trend. Based on how these orders work, a Buy limit is placed below the market, and a Buy stop - above 14/12/ · Before we go into the comparison of Limit Order and Stop Order, let’s figure out what they are separately. Limit Order. Limit Order is an instruction to execute a trade at the requested price or better. The SELL limit order is set below the current price, and the BUY limit order is Estimated Reading Time: 2 mins

No comments:

Post a Comment