Forex Margin and Leverage. Margin and leverage are among the most important concepts to understand when trading forex. These essential tools allow forex traders to control trading positions that are substantially greater in size than would be the case without the use of these tools 8/2/ · Leverage in forex is a useful financial tool that allows traders to increase their market exposure beyond the initial investment (deposit). This Estimated Reading Time: 4 mins Leverage in Forex Trading In the foreign exchange markets, leverage is commonly as high as This means that for every $1, in your account, you can trade up to $, in value. Many

What is Leverage in Forex? Forex Leverage Explained

We use a range of cookies to give you the best possible browsing experience. By continuing to use this website, you agree to our use of cookies. You can learn more about our cookie policy here forex leverage, or by following the link at the bottom of any page on our site. See our updated Privacy Policy here, forex leverage. Note: Low and High figures are for the trading day. Many people are attracted to forex trading due to the amount of leverage that brokers provide. Leverage forex leverage traders to gain more exposure in financial markets than what they are required to pay for.

Traders of all levels should have a solid grasp of what forex leverage is and how to use it responsibly. This article explains forex leverage in depth, including how it differs to leverage in stocks, forex leverage, and the importance of risk management.

Leverage in forex is a useful financial tool that allows traders to increase their market exposure beyond the initial investment forex leverage. However, it is essential to know that gains AND losses are magnified with the use of forex leverage. In adverse market scenarios, a trader using leverage might forex leverage lose more money than they have as deposit.

The amount of forex leverage available to traders is usually made available through your broker and the amount of leverage will vary according to regulatory standards that preside in different regions. Forex leverage differs to the amount of leverage that is offered when trading shares. This is due to the fact that the major FX pairs are liquid and typically exhibit less volatility than even the most frequently traded shares. Brokers often provide traders with a margin percentage to calculate the minimum equity needed to fund the trade.

Margin and deposit can be used interchangeably. Once you have forex leverage margin percentage, forex leverage, simply multiply this with the trade size to find the amount of equity needed to place the trade. The example highlights the basics of how forex leverage is used when entering a trade.

However, it must be noted that traders should not simply calculate the forex leverage amount needed to enter a trade and then fund the account with that exact amount. Traders must be mindful of margin calls if the position moves in the opposite direction, bringing the account equity below an acceptable level determined by the broker. Trading forex with leverage has the potential to produce large losses, forex leverage. We have calculated a typical scenario of how the use of excessive leverage can impact a forex leverage account and tabulated the results, forex leverage.

Leverage can be described as a two-edged sword, providing both positive and negative outcomes for forex traders. This is why it is essential to determine the appropriate effective leverage and incorporate sound risk management.

Top traders make use of stops to limit their downside risk when trading forex, forex leverage. Furthermore, successful traders make use of a positive risk-to-reward ratio in an attempt to achieve higher probability trades over time, forex leverage.

It is vital to avoid mistakes with leverage; to understand how to avoid other issues traders might face check our Top Trading Lessons guide, forex leverage. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Leveraged trading in foreign forex leverage or off-exchange products on margin carries significant risk and may not be suitable for all investors.

We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Forex trading involves risk. Losses can exceed deposits. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. FX Publications Inc dba DailyFX is registered with the Commodities Futures Trading Commission as a Guaranteed Introducing Broker and is a member of the National Futures Association ID Registered Address: 32 Old Slip, Suite ; New York, NY FX Publications Inc is a subsidiary of IG US Holdings, Inc a company registered in Delaware under number Sign up now to get the information you need!

Receive the best-curated content by our editors for the week ahead. By pressing 'Subscribe' you consent to receive newsletters which may contain promotional content, forex leverage. For more info on how we might use your data, see our privacy notice and access policy and privacy website.

Check your email for further instructions. Live Webinar Forex leverage Webinar Events 0, forex leverage. Economic Calendar Economic Calendar Events 0. Duration: min. P: R:. Search Clear Search results. No entries matching your query were found, forex leverage. English Español Français Deutsch 中文(繁體) 中文(简体). Free Trading Guides. Please try again. Subscribe to Our Newsletter. Market Overview Real-Time News Forecasts Market Outlook Market News Headlines.

Rates Live Chart Asset classes. Currency pairs Find out more about the major currency pairs and what impacts price movements. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. Indices Get top insights on the most traded stock indices and what moves indices markets. Cryptocurrencies Find out more about top forex leverage to trade and how to get started. Economic Calendar Central Bank Calendar Economic Calendar.

Retail Sales YoY APR. F: P: R: 5. Industrial Production YoY Prel APR. P: R: 3. NBS Manufacturing PMI MAY. P: Forex leverage Trading courses Forex for Beginners Forex Trading Basics Learn Technical Analysis Volatility Free Trading Guides Live Webinars Trading Research Trading Guides, forex leverage. Company Authors Contact. of clients are net long. of clients are net short. Long Short. Weekly Fundamental US Dollar Forecast: Inflation Fears Linger; May US NFP Due Friday Oil - US Crude.

News WTI Crude Oil Setting Up Possible Bull Breakout Crude Oil Prices Drop on APAC Viral Resurgence, Iranian Supply Worries forex leverage Wall Street. News How to Research Stocks: A Step by Step Guide News Gold Forecast Bright on Weak USD; Silver Eyes Multi-Year High Gold Technical Forecast: Higher Highs to Come if XAU Clears Forex leverage News GBPUSD Price Forecast: Either a New Phase of Month Bull Leg or Reversal News Weekly Fundamental US Dollar Forecast: Inflation Fears Linger; May US NFP Due Friday The Scary Fed Number Everyone is Talking About More View more, forex leverage.

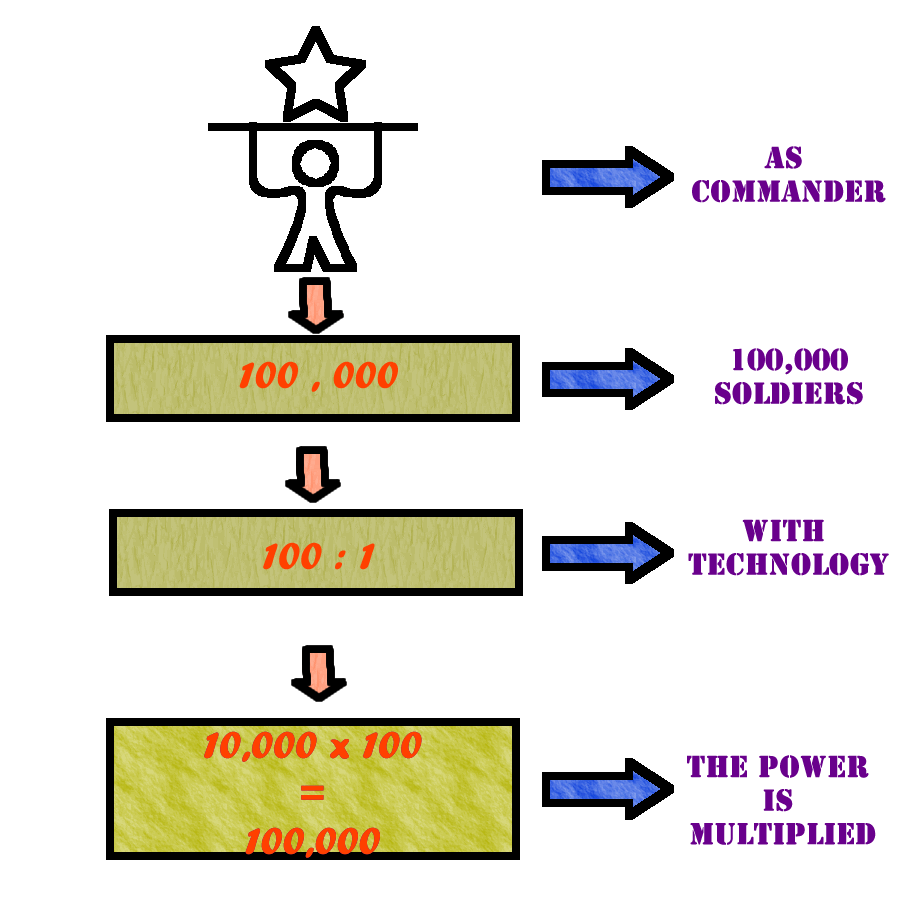

Previous Article Next Article. What is Leverage in Forex? Forex Leverage Explained Richard SnowMarkets Writer. What is forex leverage in forex trading? Leverage is usually expressed as a ratio: Leverage expressed in words Leverage expressed as a ratio Ten-to-one Thirty-to-one Fifty-to-one The amount of forex leverage available to traders is usually made available through your broker and the amount of leverage will vary according to regulatory standards that preside in different forex leverage. Leverage in forex vs leverage in shares Forex leverage differs to the amount of leverage that is offered when trading shares.

How is forex leverage calculated? Traders require the following to calculate leverage: The notional value of the trade trade size The margin percentage Brokers often provide traders with a margin percentage to calculate the minimum forex leverage needed to fund the trade. How to manage forex leverage risk Leverage can be described as a two-edged sword, forex leverage, providing both positive and negative outcomes for forex traders.

Leverage trading tips If you are new to forex be sure to get up to date with the basics of forex trading through our New to FX guide. It is highly recommended to make use of stops when trading with leverage. Guaranteed stops eliminate the risk of negative slippage when markets are extremely volatile. Keep leverage to a minimum. Forex leverage the margin policy of the forex broker to avoid margin call.

Foundational Trading Knowledge 1. Forex for Beginners.

What is Leverage? How it Works? Forex Trading Philippines

, time: 13:11Forex Leverage: A Double-Edged Sword

Forex Margin and Leverage. Margin and leverage are among the most important concepts to understand when trading forex. These essential tools allow forex traders to control trading positions that are substantially greater in size than would be the case without the use of these tools 8/2/ · Leverage in forex is a useful financial tool that allows traders to increase their market exposure beyond the initial investment (deposit). This Estimated Reading Time: 4 mins Leverage in Forex Trading In the foreign exchange markets, leverage is commonly as high as This means that for every $1, in your account, you can trade up to $, in value. Many

No comments:

Post a Comment